Due to a number of questions about the so called Dash "instamine issue", the purpose of this document is to provide an official statement from the Dash team about Core Group regarding this matter. Our intention is to provide Dash investors and users with information to help them understand the currency history and technical issues at the beginning of the project and draw their own conclusions on the impact.

Facts about the instamine

- There was no pre-mine in Dash.

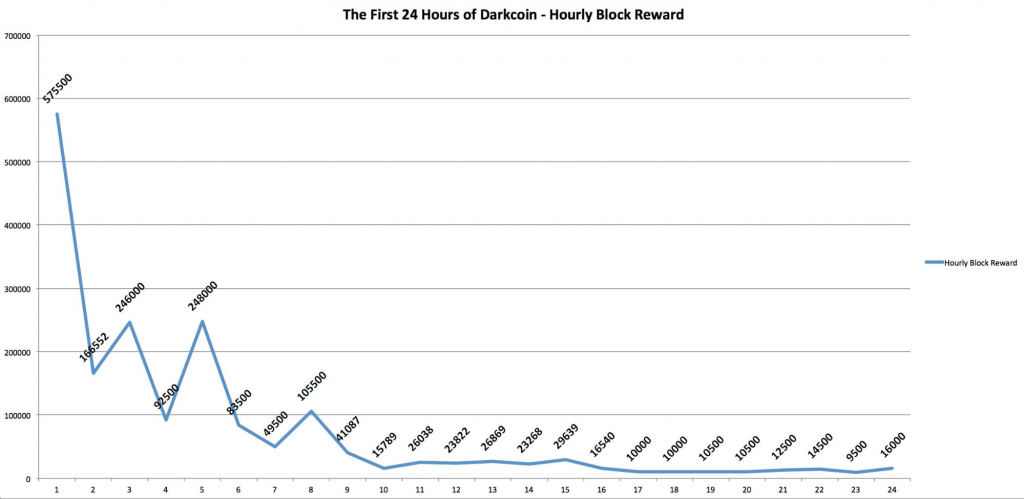

- ~1.86MM first 24h, ~2.02MM first 48h according to 57M coins were issued in the first 8h (block 3,396). The issuance speed then decreased, reaching ~1.67M coins after the first 12h (block 3,725), and 1.99M coins after about 34h, when the instamine event ended (block 4,501) according to https://chainz.cryptoid.info/dash/#@inflationThat represents approximately 10-15%

- Two separate issues caused the instamine. The main cause was a low initial difficulty that was inherited in the code from Litecoin. The second cause was a flawed block reward adjustment that affected 469 blocks beginning about 15 hours after the coin was launched.

- The only genuine error in the code related to the block reward, which was supposed to change from 277 to 56 Dash per block at block 4,033. Instead, the block reward increased to the maximum 500 per block. There had been no errors in the block reward prior to this point, at which point nearly 1.76M coins had already been created.

- The block reward bug was first reported by a user on bitcointalk.org at approximately 19:36 UTC. At that time, only 12 blocks had been issued incorrectly. There were 1.77M coins by that time (block 4,044).

- The bug causing the issue was diagnosed and a bug fix published by the lead developer in less than 2 hours, at 21:27 UTC, by which time 1.79M coins had been mined (block 4,085).

- The fix resolved the bug as of block 4,500 when it was activated on the network. At that time, approximately 1.99M coins had been issued representing approximately 10.5% of the total money supply that will ever be issuedThis coin issue rate exceeded the published emission schedule by a wide margin. This was the conclusion of the instamine.

Explanation

Dash started as an experimental project from a talented developer that was looking to see what he could do with a crypto-currencyimplement new innovations in cryptocurrency. There was no expectation that it will become what at that time that Dash would become the substantial project it is today. It has really grown organically. Adversaries of the project try to Critics of Dash present the instamine launch issues in a negative light, the reality is different:

...

as evidence of intentional deceit by the founders, but the causes of the issue, the rapid response to fix it, and the attempts to offer potential remedies seem to be consistent with the actions of a well-intentioned but flawed launch:

- XCoin (as Dash was called at the time) was based off of the Litecoin code base, which unbeknownst to the developers . Litecoin contained restrictions on the frequency and extent of adjustments which the network could apply to mining difficulty, restrictions that Litecoin inherited from its parent, Bitcoin. Because of these restrictions, and The creator of Litecoin, Charlie Lee, has said that he intentionally lowered Litecoin’s difficulty at launch (0.00024414 vs. Bitcoin’s 1.00, or 4,096 times lower), stating “If I knew what the hashrate would be at launch, I could have set the initial difficulty higher. But it was better to err on the low side to protect against 51% attacks around launch time, and that's what I did.” As a result, over 500,000 Litecoin were issued in the first 24 hours. The existence of a Litecoin instamine - caused by an intentional decision to actively lower the difficulty at launch - was not commonly known until years after Dash launched leveraging the same code.

- For several years after Dash’s launch, it was widely assumed that errors in Dash’s block reward algorithm or difficulty adjustment were responsible for the instamine. Only later research identified and quantified the various causes of the instamine.

- Because of the difficulty adjustment restrictions and a low initial difficulty inherited from Litecoin (0.00024414) - combined with the popularity of mining the coin , - the Dash network produced a large number of blocks with in a short period of time, many of which had the maximum allowable coins in each block. These went to whoever was mining and not exclusively to the developers onlyfounders. There were many people mining at the time who solved these blocks.Once the issue was recognized, the founder of

- the coin issued a fix within a few hours to adjust the difficulty more quickly than the algorithm included in the Litecoin codeIn addition, Dash had an error in the block reward algorithm that caused the reward starting at block 4,033 to revert to the maximum 500 per block (after it had been correctly issuing 277 per block prior to that point). The reward should have decreased to 56 rather than increased to 500. However, contrary to popular belief, this issue - which was a genuine mistake of the lead developer - was a minor contributor of the instamine. If the algorithm had been correct, the network would have issued the correct block reward of 56 (instead of 500) from block 4,033 to 4,501. This resulted in 208,236 unplanned coins (234,500 coins were produced during those 469 blocks vs. 26,264 that should have been created). The 208,236 extra coins that resulted from this error represent only 10.4% of the total coins issued by the end of the instamine event at block 4,501. That means nearly 90% were issued correctly per the constraints inherited from Bitcoin and Litecoin.

- After a user reported the block reward error (at 12:36pm local time), the lead developer of Dash issued a fix in just 1.85 hours (at 2:27pm local time). The speed of resolution demonstrates the urgency with which the lead developer treated the issue. Only 41 blocks were issued between the time the bug was reported and the time the lead developer issued a fix.

- It is worth noting that this bug only affected blocks beginning more than 15 hours after the coin had launched. By that point, the developers would have no special opportunity to exploit the extra coins compared to any other participant in the crypto mining community. It was also a CPU-mined coin at the time, meaning that even amateur miners would have had the opportunity to produce these extra coins. In addition, just 12 blocks were created before a user reported the issue publicly in Dash’s announcement thread on bitcointalk.org. For the subsequent 17 hours, anyone in the crypto mining community could mine the extra coins freely.

- Once the immediate issue was resolved, he the lead developer proposed several options to fix the resolve concerns with initial distribution issue by airdropping new coins to address criticism and resolve the issue. The community disagreed with the proposal and voted it down with most arguing that the distribution was already acceptable by that time (April 2014) and that the airdrop would create more problems than it would solve. For example, investors had already purchased coins from miners, so any airdrop would unfairly dilute them. In the end, the community opposed the solutions presented.

- The only two members of the development team at the time were Evan Duffield and InternetApeKyle Hagan. InternetApe Kyle Hagan sold all his coins early onwithin months when the price was a small fraction of what it is today, and is no longer involved with the project. All other members of the current team joined at later . InternetApe was able to accumulate 160K DASH over the first weeks of the project so that should provide an idea of the range a founding member was able to accumulate. So the times, and Dash Core Group wasn’t formed until 2017. The launch issues and high rewards happened to everyone equally and there was no bad intention, just part of a young hobby project that later became a much more serious one as users and investors were attracted to the project.

- These early mined tokens had no value at the time and many people just traded them OTC or sold them in exchanges very early on. There was no benchmark and no way to know Dash was going would grow to grow and become a bigger significant project, so most first day miners just seemed to have simply sold their coins.

- Dash is now a three six year old project that has already gone through three a number of major price rallies that helped with distribution and those first day miners and early investors had opportunities to exit and be compensated for their early support of the project all the way up to 17 1,400 USD/DASH. Coins have been redistributed and thanks to that early liquidity many people that are not miners were able to buy on exchanges and get involved early. Three years Years later, Dash enjoys a very healthy distribution. Though the lead developer purchased additional holdings on the open market, he is not the largest holder of Dash. The largest investors have all bought their coins from exchanges. We are happy that Evan does hold a good amount of Dash so that he is motivated to continue working on the project as the development team has done over the last three years.https://bitinfocharts.com/comparison/top100cap-dash.html

Conclusion

It was a difficult launch but , and the project faced immense criticism early in its existence. The project has acquired value because of three due to years of development, adoption, innovation, and hard work and this will continue into the future. Dash is earning has earned its place with no VC funding or ICO. Growth has been organic as the community expands and the project delivers innovations. Based Based on the presented facts, investors and users are going to have to should decide for themselves if they want to support the project and buy Dash having all necessary information about the project historyabout the likelihood of malintent at launch, and to what extent they feel the launch issues still matter today.

Reference materials:

- The birth of Darkcoin Darkcoin by

Evan Duffield (Unlicensed)

: https://dashtalk.org/threads/the-birth-of-darkcoin.162/ - Was Dash Instamined? From Legacy Dash FAQ: /wiki/spaces/DOC/pages/1867875?

- Was The Instamine A Positive Thing For Dash?: https://dashdot.io/alpha/?page_id=118

- Dash: Full interview with The Daily Decrypt at labitconf: https://youtu.be/rNZcO2vm7Jc?t=13m10s

- Dash distribution and price: https://bitinfocharts.com/darkcoin/visualization.html

- Reality Check: The Truth about Dash’s Launch! https://www.youtube.com/watch?v=O39kWbOu11M

- BCT threads